The YuTru Ecosystem

YuTru represents an ecosystem of businesses that rely on YuTru to identify and verify the identity of their customers. The YuTru ID held by a customer can be used at any of the businesses within the ecosystem, in the same way that your passport is accepted by any airport immigration counter in the world or ...

Dedupe and Recoup with YuTru

Businesses providing goods and services keep customer records to record information about customers transactions and to better serve the interests of their customers. In most cases, some sort of unique customer identifier is assigned to each customer. But what happens when a customer identifies in a slightly different way over multiple interactions with the company? ...

No Queue with YuTru

Tired of waiting in queues? Tired of traveling to a business to present paperwork to identify yourself? Is it frustrating to be told to bring in additional documents? Are you frustrated at the time it takes? What if these identification processes could be done in milliseconds and online via your smartphone or laptop? Would that ...

Your Password-less Future is Finally Here

Passwords have not been safe for a long time. Using passwords for authentication is a risk and vulnerability that can be exploited, resulting in unauthorised and malicious access to digital systems and user accounts.

For example, a customer with several personal accounts requires a few sets of username and passwords: one set for each online account. ...

Hand Over Your Data, or Go YuTru

From the 1st February, the Australian Department of Home Affairs will start collecting biometrics from Papua New Guineans who are applying for a visa to Australia. In line with international standards, a face and 10-digit fingerprint scan will be required and that data stored in Australia. In the same way that the Australian Government will ...

Not All Digital Identities Are Created Equal

The digital economy is growing rapidly and the pandemic has accelerated this transformation, where customers are expected to do more online. Banking especially, is being digitalised and the need to travel into a branch is a significant and unnecessary ‘pain point’ for customers. Regulated financial institutions like banks and money transfer agents are governed by ...

YuTru Journey

YuTru is a local business, wholly owned in Papua New Guinea for the benefit of Papua New Guineans. It was established in 2018, with the support of the Government of Australia, and an MOU with the Bank of Papua New Guinea. Since then we have been conducting training sessions and building a digital identity trust ...

The Reason for YuTru

Today, in Papua New Guinea it is difficult to prove who you are and that you are trustworthy. Each institution that onboards a new customer employs a range of techniques to understand who the customer is. An institution will ask a new customer to fill out paper-based forms, provide copies of a driver's license or a ...

Due Diligence Period Closes in 7 Days

We are now 7 days from the close of the YuTru due diligence period.

We have fielded questions and taken calls from various staff across the 8 national firms that have formally expressed interest.

Please feel free to connect with either of the advisers: Josh Mua (+675 308 3767 of Kina Bank Ltd.) or Tony Willenberg (+675 7993 7369 ...

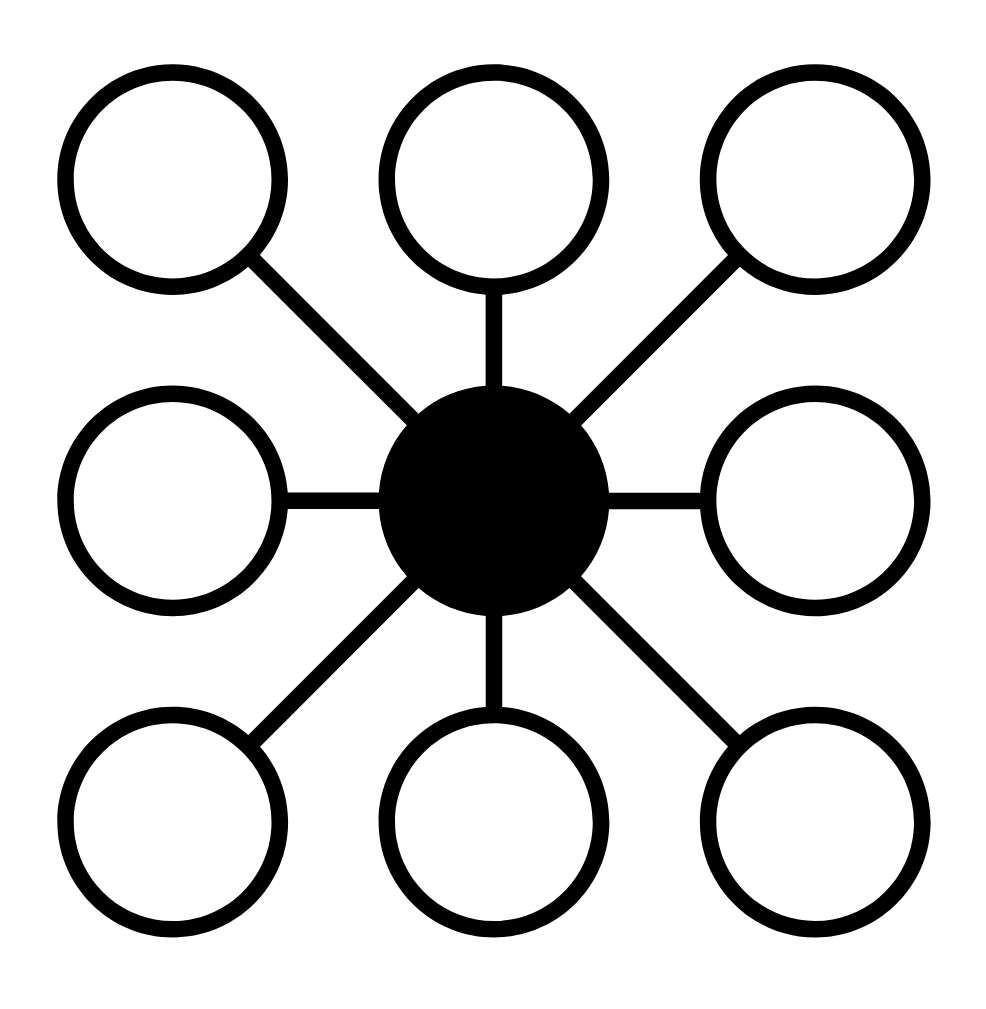

Stakeholder Map

The “Stakeholder Map” sets out the roles of stakeholders who comprise and interoperate in the YuTru digital ecosystem, to provide digital, natural, and legal persons in PNG with a digital identity.

A digital identity can be used online and offline. It can be carried in a mobile phone, stored in “the cloud”, or worn in a ...