The Reason for YuTru

Today, in Papua New Guinea it is difficult to prove who you are and that you are trustworthy. Each institution that onboards a new customer employs a range of techniques to understand who the customer is. An institution will ask a new customer to fill out paper-based forms, provide copies of a driver’s license or a passport, list professional and personal referees, or to produce a credit report.

This is difficult for most people to provide, especially when it is required at each and every institution they do business with. The life of a customer engaging in normal economic activity involves repeatedly proving who they are. What’s required also varies between institutions. A bank may require one set of evidence and an insurance company another and a mobile service provider yet another set of evidence.

In some cases an institution is required by law or regulation to know who the customer is, say, in the case of a financial institution. In other cases an institution is trying to establish to a reasonable degree of certainty who the person is or create a financial incentive for the person to do the right thing.

The absence of a single universal method for knowing with certainty who a person is comes at a cost to customers, to businesses, to the government, and the economy as a whole. Doing business in PNG has a minimum level of friction which cannot be overcome or avoided because of a lack of a robust way of knowing who people are.

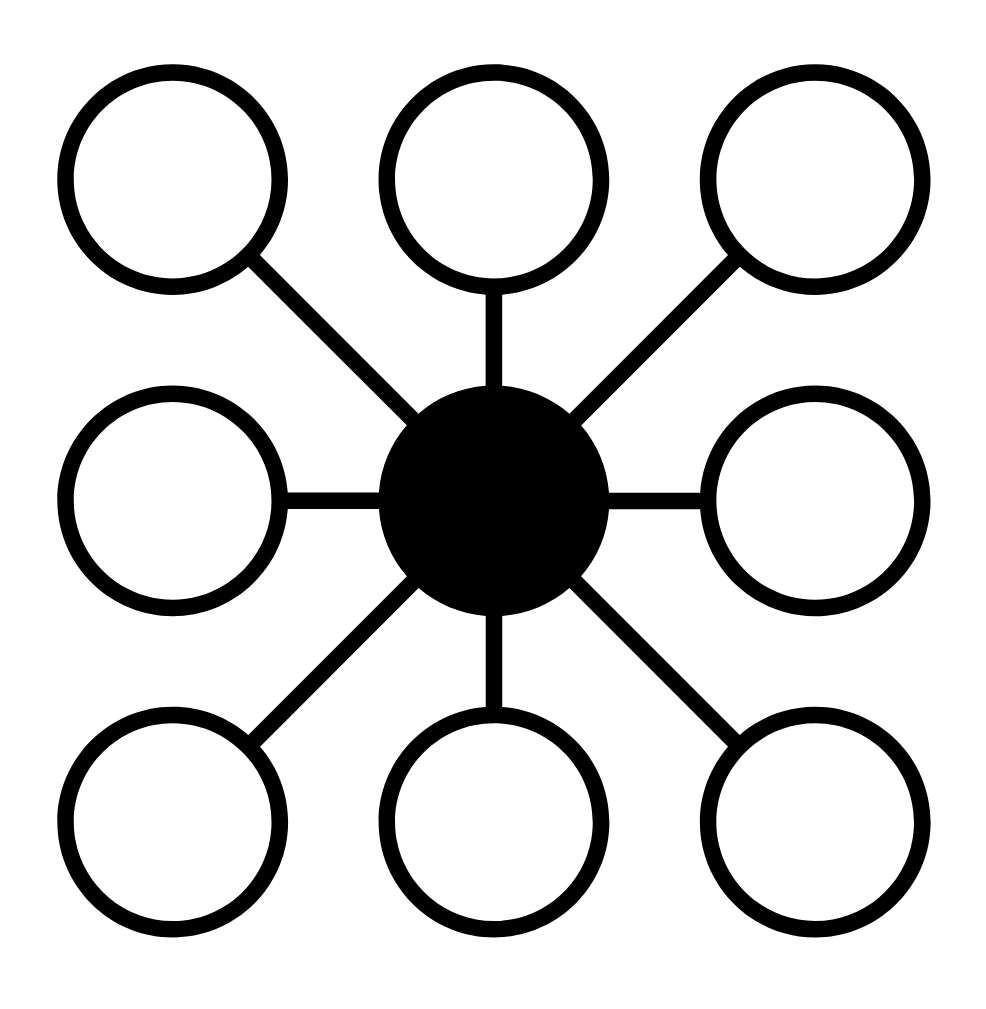

YuTru is designed to overcome this challenge. Like SingPass in Singapore, or RealMe in New Zealand, or Digital iD in Australia, Papua New Guineans can now obtain a single YuTru credential that is accepted by all major institutions in the country.

A YuTru ID will (eventually) be accepted by banks, superannuation funds, insurance providers, health providers, airlines, utility providers, and mobile carriers, among others because of its state-of-the-art security and privacy and its consistent approach to knowing who a person is. A YuTru ID can be verified by an institution in real time online or carried offline by a user in their mobile phone or on the very same bank card they received from their bank.

YuTru is free to anyone who wants one and it can be registered for online and so won’t require extensive travel or waiting times to get. YuTru is a modern, interoperable, secure digital ID, based on international and regional standards making it recognisable to institutions abroad too. We are working to line up a comprehensive range of businesses both here and abroad that will accept your YuTru ID from the day you get it. YuTru uses digital technology rather than relying on someone’s name and date of birth alone to establish and then prove to others that there is one, and only one, true You.

For more information contact: office at yutru dot org