Blockchain Pasifik 2018

In 2013, the Bank of Papua New Guinea (BPNG) took on the challenge of expanding financial inclusion in the country. The lack of government-issued documentation with which citizens can prove their legal identity, however, makes this a sizeable problem.

Licensed financial institutions (LFI) are required to ‘know their customer’ (KYC) to manage risk and help prevent financial crimes. KYC is needed to both comply with regulation as well as to maintain relationships with other international financial institutions. In PNG, around 95% of the population do not have the government-issued documents, like a birth certificate and passports, which are required to meet LFI requirements. As a result, these people cannot hold a bank account and are financially excluded from the economy.

The BPNG, through the PNG Digital Commerce Association, is driving the establishment of a private sector-led consortium of LFIs to develop the country’s first digital trust framework, known as YuTru.

The YuTru digital trust framework is a set of rules and standards for managing digital identity. YuTru will become a trusted brand. LFIs will display the YuTru logo to show that they follow the scheme’s rules, and other commercial organisations will display the logo as a sign that they trust YuTru credentials. A citizen will identify themselves once and be identifiable everywhere they do business.

Other countries such as India and Thailand have successfully overcome the problem of large undocumented populations by leapfrogging over programs to issue government source documents and moving directly to e-KYC schemes. In India, the ‘Aadhaar’ scheme now boasts some 130 million citizens whose only source document is themselves – their biometric readings are their source document – they have never held government-issued source identity documentation.

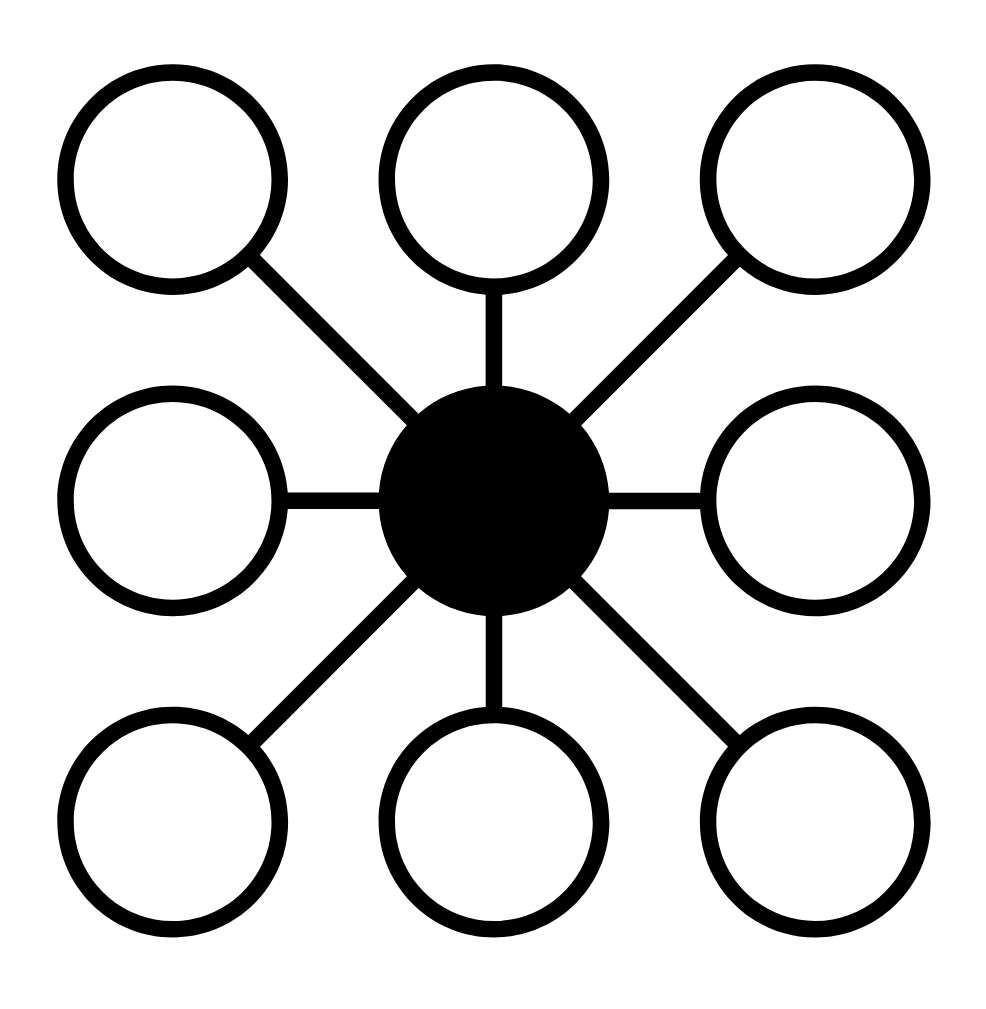

The YuTru scheme is likely to be a world-first, uniquely combining three identity management features: (a) multiple biometric measures, (b) distributed ledger technology to securely register data without centralisation to any one institution, and (c) an introducer-based method to formalise and record referrals from existing bank customers to vouch for new customers.